![]()

Data is necessary to drive transformative change across industries in today’s hyperconnected world. In the financial services sector, the power of real-time credit data is undeniable. It equips financial institutions with the ability to understand their consumers, predict their needs, and thrive in a competitive landscape. This data is a tool and a catalyst for growth, offering unparalleled insights into consumer behavior, credit trends, market dynamics, and competitor strategies. This is why using Real-Time Credit Data: Fueling Banking Innovation and Growth is key to your financial success!

At the heart of this evolution lies the ability to harness real-time credit data—a wealth of information that provides banks unparalleled insights into consumer behavior, credit trends, market dynamics, and competitor strategies. From understanding the share of wallet to identifying emerging trends, the benefits of real-time credit data are infinite and far-reaching.

Understanding Consumer Behavior

Companies that master personalization can increase their growth rates by 6% to 10%, according to BCG. Real-time credit data offers financial institutions a window into their consumers’ financial lives, providing valuable insights into spending patterns, credit utilization, and repayment behaviors. By analyzing this data in real-time, they can develop a holistic understanding of their consumer financial habits, preferences, and needs, allowing them to tailor products and services to serve their consumers better.

Anticipating Personal Finance Needs

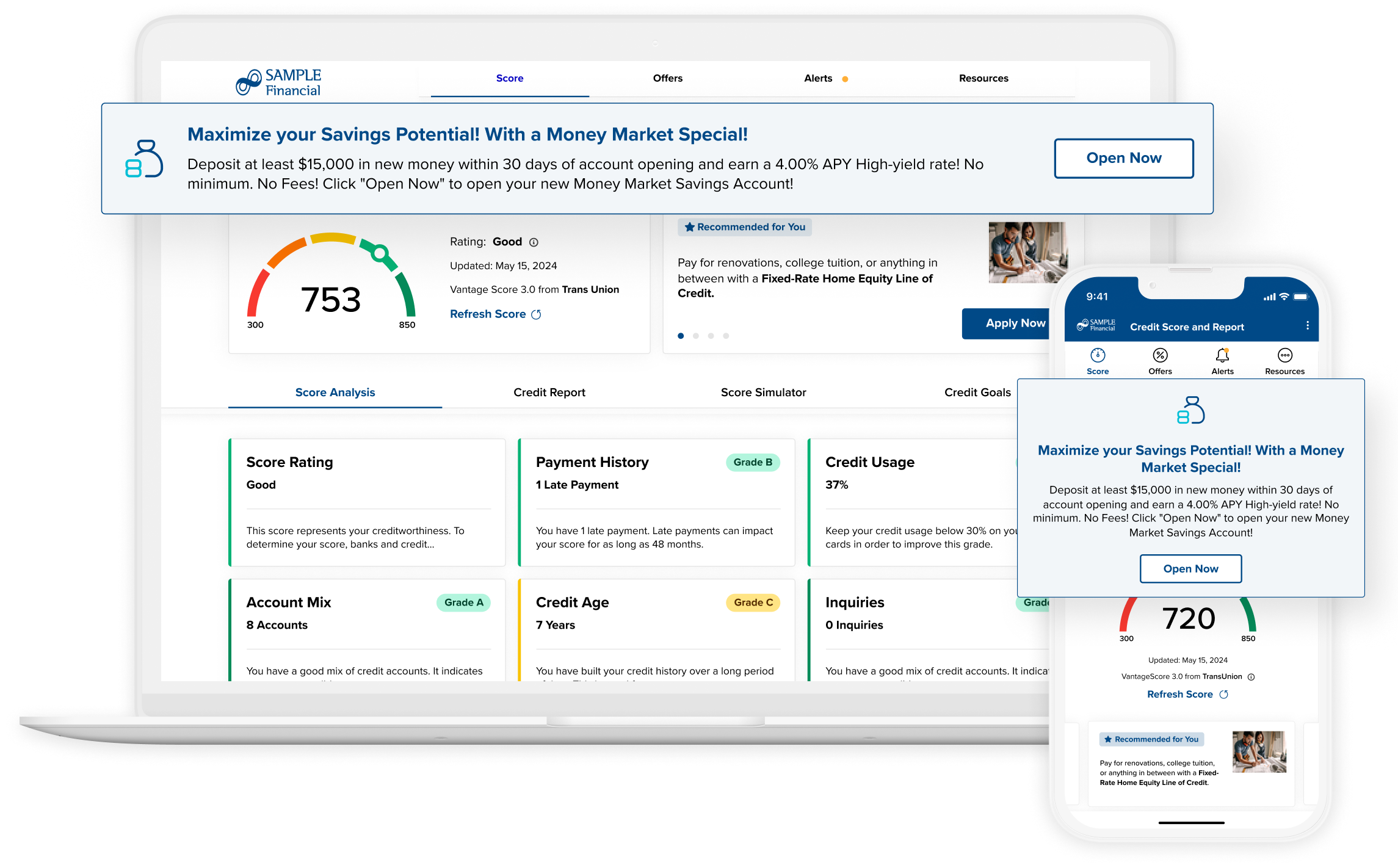

In the fast-paced banking world, staying one step ahead is essential. Real-time credit data enables financial institutions to anticipate consumer needs and proactively offer personalized solutions. Whether identifying opportunities for credit line increases, recommending relevant financial products, or providing targeted offers, access to real-time credit data empowers them to deliver timely and relevant solutions that resonate with their consumers. According to Twilio, 69% of business leaders are increasing their investment in personalization, even with economic headwinds.

Gaining Competitive Insights

Knowledge is power in the fiercely competitive banking landscape. Real-time credit data gives financial institutions invaluable insights into competitor strategies, market trends, and emerging opportunities. By monitoring competitor activity and analyzing market dynamics in real-time, they can fine-tune their strategies, identify areas for growth, and stay ahead of the curve in an ever-evolving market.

Optimizing Risk Management

Real-time credit data is not just about understanding consumers and driving growth. It also plays a crucial role in risk management. Effective risk management is paramount in the financial services industry, and real-time credit data is a game-changer. It allows financial institutions to assess credit risk in real-time, make informed lending decisions, identify potential red flags early on, and mitigate risks effectively. Banks can leverage real-time credit data to enhance their risk management processes, improve credit underwriting practices, and safeguard their financial health.

Enhancing Consumer Experience

In an era where customer experience reigns supreme, real-time credit data drives consumer satisfaction and loyalty. By leveraging real-time credit data to deliver personalized experiences, financial institutions can deepen consumer relationships, foster trust, and enhance overall satisfaction. Whether it’s offering tailored product recommendations, providing proactive financial advice, or delivering seamless digital experiences, access to real-time credit data enables banks to create meaningful connections with their consumers. In fact, according to Twilio, 56% of consumers who get real-time personalized recommendations say they will be more loyal and repeat consumers of a brand, which is a 7% increase year-over-year.

Driving Business Growth

Real-time credit data is not just a tool. It’s a fuel for business growth and innovation. By harnessing the insights from real-time credit data, banks can identify new revenue opportunities, optimize operational efficiencies, and drive sustainable growth. From expanding market share to increasing wallet share, access to real-time credit data empowers banks to thrive in today’s dynamic and competitive landscape. The potential of real-time credit data to transform the financial services industry is immense, and its adoption is a strategic move toward success in an increasingly digital and data-driven world.

The importance of real-time credit data in driving banking innovation and growth cannot be overstated. According to Capco research, 72% of your consumers found it ‘highly important’ to have a personalized banking experience. By leveraging real-time credit data to gain a deeper understanding of consumer behavior, anticipate customer needs, gain competitive insights, optimize risk management, enhance customer experience, and drive business growth, banks can unlock a world of possibilities and position themselves for success in an increasingly digital and data-driven world.

Source: