View as PDF >>

AT A GLANCE

About Liberty Bank: 138,773 Digital Banking Users, $7.4B+ in Assets

SavvyMoney Partnership: Launched in February 2023

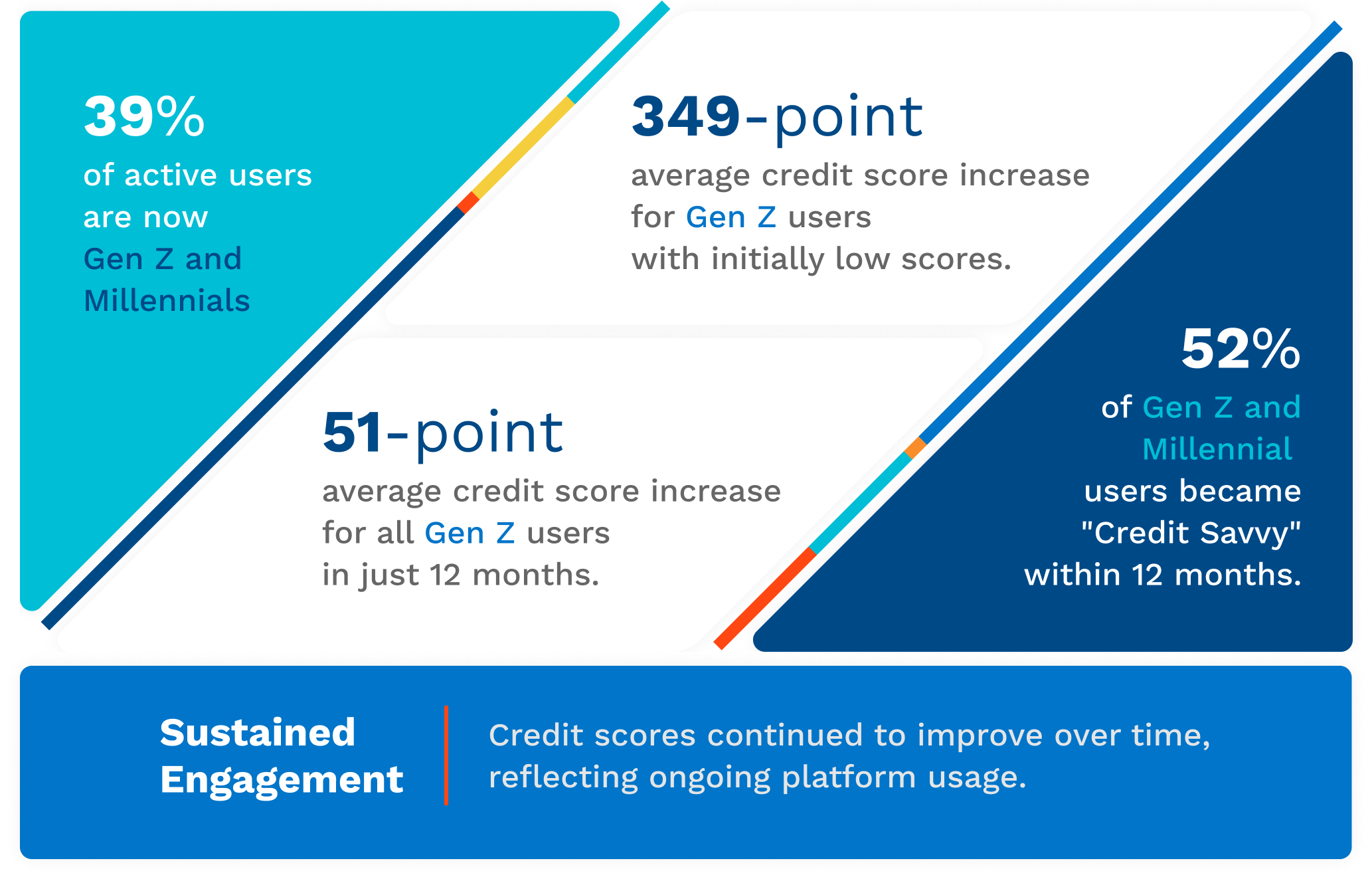

Impact: 39% of active users are now Gen Z and Millennials; 349-point average credit score increase for Gen Z users with initially low scores; 51-point average credit score increase for all Gen Z users in just 12 months.

OPPORTUNITY

Liberty Bank, a financial institution with over $7.4 billion in assets, had a goal to better engage with Gen Z and Millennial customers. With 138,773 digital banking users, the bank recognized the need to:

- Engage younger customers effectively

- Provide meaningful tools to improve financial health

- Boost digital banking adoption and usage

- Build long-term loyalty among the Gen Z and Millennial demographic

SOLUTION

To address these goals, Liberty Bank partnered with SavvyMoney to launch a comprehensive credit score and financial health platform. The solution included:

- Real-time Credit Score Access: Seamless and instant access to credit scores

- Personalized Credit Education: Tailored tips and advice for improving credit health

- Credit Score Simulator: An interactive tool to model how financial decisions impact credit scores

- Mobile-First Design: Optimized for the tech-savvy, on-the-go lifestyle of younger customers

- Gamification Features: Encouraging regular engagement and progress of financial wellness

- Integrated Offers: Personalized product recommendations based on users’ credit profiles

RESULTS

Since implementing SavvyMoney in February 2023, Liberty Bank has seen impressive results:

“SavvyMoney has helped us connect with Gen Z and Millennial customers. The combination of personalized financial tools and insights has not only empowered these young adults but also strengthened their loyalty to Liberty Bank. Watching our community of customers achieve such remarkable credit score improvements has been incredibly rewarding, and we look forward to continuing this momentum with SavvyMoney.”

– Lizette Nigro, SVP, Digital Engagement, Liberty Bank

Supporting Data:

- Gen Z and Millennial Users: 39.3% of active users (11,512 individuals)

- Gen Z (Ages 14-27)

- 50% become Credit Savvy within 12 months

- Average increase of 116.4 points after 12 months

- Users with initial scores below 650 saw an astounding average increase of 348.6 points after 12 months

- All Gen Z users averaged a 51.2-point increase after 12 months

- Millennials (Gen Y.1 & Y.2, Ages 28-43) and Gen Z Combined

- 51.7% become Credit Savvy within 12 months

- Average increase of 66.1 points after 12 months

- Users with initial scores below 650 saw a remarkable average increase of 222.3 points after 12 months

- All Millennial and Gen Z users averaged a 23.5 point increase after 12 months